BestCreditOffers.com is an independent, advertising-supported website which receives compensation from the credit card issuers and companies whose offers appear on the site. Compensation may impact how and where products appear on our site, including, for example, the order in which they may appear on the site pages. BestCreditOffers.com does not review or list all available financial or credit offers.

CREDIT CARDS & LOANS FOR AVERAGE CREDIT IN 2024

April 2024: BEST CREDIT OFFER FOR FAIR CREDIT

- No credit check

- 0% APR and No hidden fees

- Open your account in minutes

- Bank-level security keeps your data safe

This offer is not available in Delaware and Indiana.

More Credit Cards for Fair Credit

- See Your Rate In Minutes

- Get Your Free Experian® Credit Report

- Compare Low Interest Personal Loans Up To $100,000. Get An Online Quote In Minutes!

- Get Matched To Personal Loan Offers Based On Your FICO® Score Even If You Have Bad Credit.

- Build credit & Earn rewards.

- Payment performance is reported monthly to TransUnion, Equifax, Experian, and Innovis.

- Track your credit score every month.

- Learn with courses and pick up useful skills.

- Earn 1% back on loan offers. Up to $1,225.

- 0% APR / $0 fees. Instant approval. No credit check.

This offer is not available in MA, ME, ND, NH, NV, OR, RI, TN, VT.

- Get Personalized Credit Card Offers Based on Your Credit File from Experian®. 100% Free!

- Credit Cards Matched For You

- Compare Credit Card Offers

- See Cards In Under 60 Seconds

This offer is not available in MA, ME, ND, NH, NV, OR, RI, TN, VT.

- Unlock a $1,000 average Spending Limit instantly.

- Shop top brands in the Perpay Marketplace (Apple, Sony, MCM, Nike & more).

- No interest, fees, or credit check.

- Pay over time with easy payments from your paycheck.

- Shop and build credit by 36 points on average.

This offer is not available in Colorado, Massachusetts, West Virginia, Wisconsin.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

- Fast and easy application process; results in seconds

- Online account access 24/7

- Checking Account Required

This offer is not available in Colorado, Massachusetts, West Virginia, Wisconsin.

- PREMIER Bankcard credit cards are for building** credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build** your credit.

- No Monthly Fees.

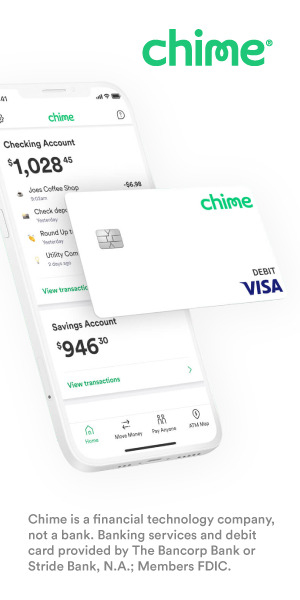

- Get fee-free overdraft up to $200* with SpotMe®.

- Set up Direct Deposit and get your paycheck up to 2 days earlier^ than some of your co-workers!

- Banking services and debit card provided by The Bancorp Bank N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

- *SpotMe® on Debit is an optional, no fee overdraft service attached to your Chime Checking Account. To qualify for the SpotMe on Debit service, you must receive $200 or more in qualifying direct deposits to your Chime Checking Account each month and have activated your physical Chime Visa® Debit Card or secured Chime Credit Builder Visa® Credit Card. Qualifying members will be allowed to overdraw their Chime Checking Account for up to $20 on debit card purchases and cash withdrawals initially but may later be eligible for a higher limit of up to $200 or more based on Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. The SpotMe on Debit limit will be displayed within the Chime mobile app and is subject to change at any time, at Chime's sole discretion. Although Chime does not charge any overdraft fees for SpotMe on Debit, there may be out-of-network or third-party fees associated with ATM transactions. SpotMe on Debit will not cover any non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. SpotMe on Debit Terms and Conditions.

- ^Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 2 days earlier than the scheduled payment date.

- Buy Now and Pay Later with Masseys Credit

- Grow your credit with responsible use

- Masseys Credit Lines Up To $500!

- No annual fee

- Payments as little as $5.99 per month

- Conventient online account access

- Don’t let a low FICO score stop you from applying – we approve applications others may not.

- You don’t need good credit to apply.

- Just complete the short application and receive a response in 60 seconds.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- FICO scores are used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any PREMIER Bankcard® product.

- All the benefits of a Mastercard, without a security deposit

- 24/7 access to your account, even on mobile!

- Reports to all three major credit bureaus

- Less than perfect credit is okay, even with a prior bankruptcy!

- Simple and fast application process

- Greater access to credit than before - $700 credit limit

- $0 Fraud Liability* for unauthorized use offers you peace of mind

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

- Everyone deserves a chance to build** credit: apply today!

- PREMIER Bankcard credit cards are for building** credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- We'll provide you a manageable credit limit and manageable payments meant to help you stick to your budget.

- FICO scores are used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any PREMIER Bankcard® product.

- You don’t need good credit to apply.

- We help people with bad credit, every day.

- Just complete the short application and receive a response in 60 seconds.

- You can build or rebuild your credit: apply for a PREMIER Bankcard credit card, keep your balance low, and pay all your monthly bills on time.

- Don’t let a low FICO score stop you from applying – we approve applications others may not.

- FICO scores are used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any PREMIER Bankcard® product.

This offer is not available in U.S. territories.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Good anywhere Mastercard® is accepted

- $0 fraud liability**

- Free access to your VantageScore 4.0 credit score from TransUnion®†

This offer is not available in U.S. territories.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- No security deposit required, even with less than perfect credit

- Simple application process with a quick response

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

Fair Credit Card Offers

People with fair credit may experience difficulty getting approved for credit cards with low interest rates. On the other hand, a fair credit card holder should not be subject to the same harsh terms and high fees as someone with bad credit. Get out of the grey area and use these tips to reestablish your credit rating and enjoy the convenience of a credit card!

- Rebuild your credit. There are in fact great credit card options for people with less than perfect credit history. These cards can help you rebuild your credit by making timely bill payments and keeping account balances low relative to the credit limit.

- Get a co-signer. A co-signer will increase your chances of approval because it gives you further financial backing. The point is to compensate for your deficient credit score, so find someone with a stable job and good credit history.

- Be realistic about your expectations. It is possible that your application may be denied or that you will pay a higher interest rate than an applicant with a high credit score.

- Reap the benefits. Even with fair credit, cardholders can enjoy incentives like cash back offers, 0% introductory APR, low or no annual fees, low balance transfer fees, and built-in features to help card holders establish good credit like cash back on purchases when monthly bills are paid on time.

So do not let your less than stellar credit history dissuade you from applying for a credit card. Apply today to start rebuilding your score and enjoying the rewards!

Not Sure Which Card to Choose?

User Comments about Credit Cards for Fair Credit

COME GET IN TOUCH WITH US

Never miss a new article, review or a credit product. Follow us in social networks, leave comments, and share your thoughts. Subscribe to receive latest news and trending offers on the credit card market to find the credit card that will save you money and give you perks and rewards.

Please specify the following:All these fields are optional

Thank you for providing this information! We will make sure our letters are useful for You.