BestCreditOffers.com is an independent, advertising-supported website which receives compensation from the credit card issuers and companies whose offers appear on the site. Compensation may impact how and where products appear on our site, including, for example, the order in which they may appear on the site pages. BestCreditOffers.com does not review or list all available financial or credit offers.

Balance Transfer Credit Card Offers for 2024

NB! You cannot transfer a balance between credit cards from the same bank.

April 2024: TOP BALANCE TRANSFER OFFER

- Earn 10,000 bonus Rewards Points when you spend $2,000 in the first 60 days

- Earn 1 point for every $1 spent on everyday purchases

- No annual fee or balance transfer fee

More Balance Transfer Credit Cards

- Earn 20,000 bonus Rewards Points when you spend $3,000 in the first 60 days

- Earn 2 Rewards Points for every $1 spent on groceries, gas, electronics, medical, household goods and telecommunications and 1 Reward Point for every $1 spent on all other purchases

- Redeem Reward Points for travel, merchandise, events, experiences, gift cards and cash

- No points maximum and your points never expire

- Transfer and pay off your debt at 0% Intro APR on Balance Transfers; ongoing variable APR applies after that.

- There is a balance transfer fee.

- Earn cash back or point rewards on all purchases. Rewards won’t expire.

- $0 liability on unauthorized purchases. No annual fee.

- Earn 10,000 bonus Rewards Points when you spend $2,000 in the first 60 days

- Earn 1 point for every $1 spent on everyday purchases

- No annual fee or balance transfer fee

- Points never expire while account is open and in good standing

- Redeem points for travel, merchandise, events and activities, charitable donations, and gift cards

Balance Transfers 101

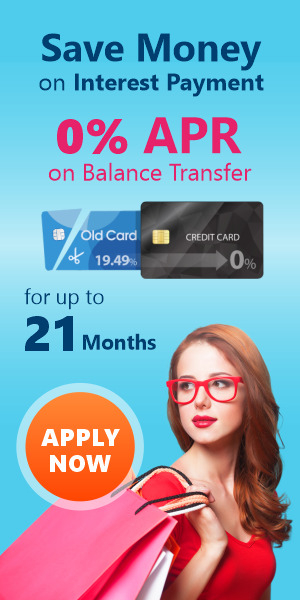

High unemployment rates, salary cuts, and foreclosures - these are just some of the negative effects of the ongoing recession. But believe it or not there's actually an upside to the economic downturn. Several banks and financial institutions are now bombarding customers with good to excellent credit scores with balance transfer credit card offers. Balance transfer credit cards are ideal for individuals with outstanding balances on several cards and designed to help people consolidate all their credit card debt on to one card. These cards are also an excellent way to reduce monthly interest payments by hundreds of dollars a year. For example, if you have an outstanding balance of $5,000 with a 21% interest rate, transferring to a card with a 0% introductory APR for a year will save you around $400 in interest payments!

Here are a few points to consider:

- Is a balance transfer credit card right for you? First, determine if you will be eligible for a balance transfer credit card. Having a bad credit and knowingly applying for a balance transfer credit card, with unrealistic expectations may result in rejection and hard inquiry in your credit history.

- Calculate how much you will save. After you determine whether or not you are eligible for a balance transfer credit card, it is important to calculate how much you stand to save by transferring all or a portion of your credit card balance.

- Note the details of the rates. Fees with balance transfer cards can be tricky, so it's important that you know the exact details of your card.

Not Sure Which Card to Choose?

User Comments about Low Balance Transfer Credit Cards

COME GET IN TOUCH WITH US

Never miss a new article, review or a credit product. Follow us in social networks, leave comments, and share your thoughts. Subscribe to receive latest news and trending offers on the credit card market to find the credit card that will save you money and give you perks and rewards.

Please specify the following:All these fields are optional

Thank you for providing this information! We will make sure our letters are useful for You.